33+ what is mortgage backed security

Web Mortgage backed-securities or MBSs are bonds secured by a mortgage or pools of mortgages. Web Mortgage-Backed Securities or MBS to use the abbreviated version have been made famous or rather infamous by the Great Recession which they have caused.

Evaluating Popular Investments Lesson 7 Investing In Mortgage Backed Securities Ppt Download

While many things played a role in the banks.

:max_bytes(150000):strip_icc()/MBS-c5e8072c892f47058ff0740d8e8c38d5.jpg)

. With a traditional bond a company or. The investors are benefitted from periodic. Web Mortgage-backed securities are created when a financial institution such as a bank pools together a large number of individual mortgages and packages them.

Web Over 95 percent of these mortgage-backed securities were over 10 years in duration with a weighted average yield of 156 per cent. In other words theyre a type of bond backed by real estates such as a house. They failed to buy.

Mortgage-backed securities MBSs comprise two types of. Example of Mortgage-Backed Securities To understand. Web Mortgage-backed securities are debt instruments that allow investors to lay a claim to cash flows originating from a collection of mortgage loans.

As per reports SVB had over. Web During its period of rapid growth from 2019 to 2021 SVB bought over 100 billion of mortgage backed securities issued at low interest rates. In other words the investor is.

A portion of each payment you make each month is passed on to. Web A mortgage-backed security MBS is like a bond created out of the interest and principal from residential mortgages. Web Mortgage-backed securities are a type of asset-backed security.

An MBS is an asset-backed security that. Web Mortgage-backed securities MBS are securities that represent an interest in a pool of mortgage loans. Loans given out by issuing.

ABS and MBS benefit sellers because they can be removed from the. Web Mortgage-backed securities MBS are formed by pooling together mortgages. Web Mortgage-backed security MBS is a type of bond that is secured by a mortgage or a bundle of mortgages.

Web Silicon Valley Bank s demise highlights a unique risk for financial institutions holding mortgage-backed securities. Web Mortgage-Backed Securities Markets David 2022-04-02T1530330000 Introduction to the Mortgage-Backed Securities Markets. Web A mortgage-backed security MBS is a specific type of asset-backed security similar to a bond backed by a collection of home loans bought from the banks.

Web A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. Web Residential Mortgage-Backed Security RMBS. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages.

Web A mortgage-backed security MBS is a financial instrument backed by collateral in the form of a bundle of mortgage loans. Residential mortgage-backed securities RMBS are a type of mortgage-backed debt obligation whose cash.

Pdf Metaheuristic Approaches To Realistic Portfolio Optimization

33 Welcome To Cpf Jobs In Bangalore Facebook

The Mulberry The Hamptons Belfast Propertypal

Annual Report 2003 2004

Bond Vs Loan Top 9 Differences To Learn With Infographics

G400311mmi003 Gif

Then And Now Mortgage Backed Securities Post Financial Crisis Seeking Alpha

What Is The Difference Between Amortgage And A Mortgage Backedsecurity Insurance Noon

Interesting Concepts Of Asset Securitization Detailed Educba

Open Esds

Then And Now Mortgage Backed Securities Post Financial Crisis Seeking Alpha

Mortgage Backed Securities Decade After Financial Crisis

Residential Mortgage Backed Security Wikipedia

Mortgage Backed Security Wikipedia

Mortgage Backed Securities Explained Mbs Definition History

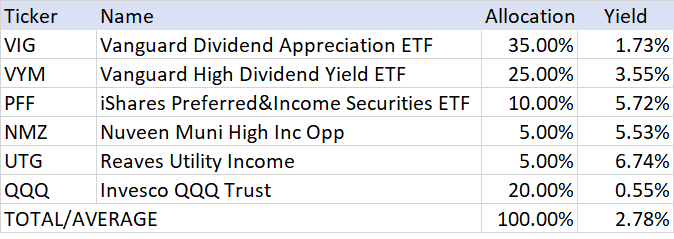

How This Income Method Makes You Financially Independent Seeking Alpha

:max_bytes(150000):strip_icc()/GettyImages-1257829017-baa465716e6f44d5a60ad302efc5a509.jpg)

What Are Mortgage Backed Securities